Search Bar

Promissory Note-Assorted Legal Forms

What is a promissory note?

A promissory note is the promise in written, to pay a sum to a certain person or the bearer on demand or on a date that has been specified beforehand. It is a legal document and implies the person or institution who has signed it to pay a certain amount of money to the aforesaid person at a time that has been predetermined or on the demand of the aforesaid person. This note can be unconditional and salable to be known as negotiable instrument.

Laws of many states consider promissory notes as a common means of carrying out transactions. The countries that allow deferred payments have provisions of promissory notes. If the company is fearing insolvency due to deferred payments they can ask one of their borrowers to write a promissory note to them which will enable the lender to get the cash against the promissory note. This cash can then be used to solve the insolvency. However, the borrower is now suppose to pay a certain amount as per the one mentioned on the note, to the bank, failing which the bank may return to the lender for the money. In this way the promissory note is a kind of money that is used by the institutions privately.

The promissory note must contain the principal amount, interests, the names of both the parties, the date of payment, the terms of repayment and the date of maturity upon which the bank may ask for the lent money.

Where to download Promissory Note-Assorted Legal Forms Template?

(No Ratings Yet)

(No Ratings Yet)Sample Template Preview

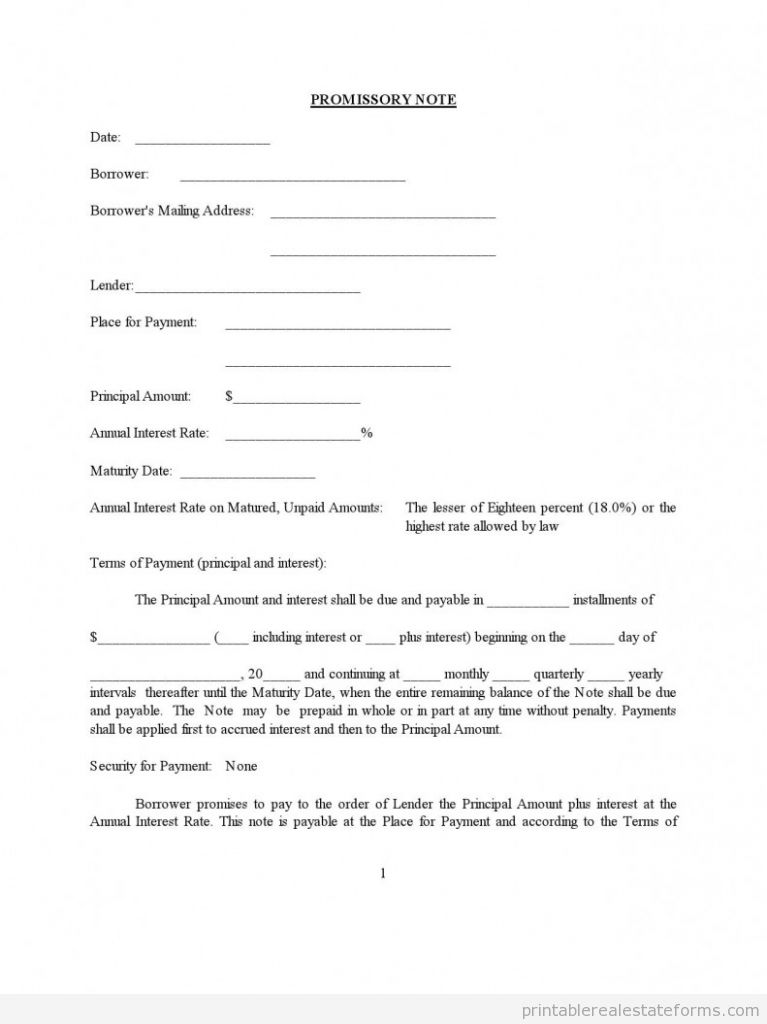

Date: __________________

Borrower: ______________________________

Borrower’s Mailing Address: ______________________________

______________________________

Lender: ______________________________

Place for Payment: ______________________________

______________________________

Principal Amount: $_________________

Annual Interest Rate: __________________%

Maturity Date: __________________

Annual Interest Rate on Matured, Unpaid Amounts: The lesser of Eighteen percent (18.0%) or the highest rate allowed by law

Terms of Payment (principal and interest):

The Principal Amount and interest shall be due and payable in ___________ installments of

$_______________ (____ including interest or ____ plus interest) beginning on the ______ day of

____________________, 20_____ and continuing at _____ monthly _____ quarterly _____ yearly

intervals thereafter until the Maturity Date, when the entire remaining balance of the Note shall be due and payable. The Note may be prepaid in whole or in part at any time without penalty. Payments shall be applied first to accrued interest and then to the Principal Amount.Security for Payment: None

Borrower promises to pay to the order of Lender the Principal Amount plus interest at the Annual Interest Rate. This note is payable at the Place for Payment and according to the Terms of Payment. All unpaid amounts are due by the Maturity Date. After maturity, Borrower promises to pay any unpaid principal balance plus interest at the Annual Interest Rate on Matured, Unpaid Amounts.

If Borrower defaults in the payment of this note or in the performance of any obligation in any instrument securing or collateral to this note, Lender may declare the unpaid principal balance, earned interest, and any other amounts owed on the note immediately due. Borrower and each surety, endorser, and guarantor waive all demand for payment, presentation for payment, notice of intention to accelerate maturity, notice of acceleration of maturity, protest, and notice of protest, to the extent permitted by law.Borrower also promises to pay reasonable attorney’s fees and court and other costs if this note is placed in the hands of an attorney to collect or enforce the note. These expenses will bear interest from the date of advance at the Annual Interest Rate on Matured, Unpaid Amounts. Borrower will pay Lender these expenses and interest on demand at the Place for Payment. These expenses and interest will become part of the debt evidenced by the note and will be secured by any security for payment.

Interest on the debt evidenced by this note will not exceed the maximum rate or amount of nonusurious interest that may be contracted for, taken, reserved, charged, or received under law. Any interest in excess of that maximum amount will be credited on the Principal Amount or, if the Principal Amount has been paid, refunded. On any acceleration or required or permitted prepayment, any excess interest will be canceled automatically as of the acceleration or prepayment or, if the excess interest has already been paid, credited on the Principal Amount or, if the Principal Amount has been paid, refunded. This provision overrides any conflicting provisions in this note and all other instruments concerning the debt.

Borrower will be in default if (1) Borrower fails to timely pay or perform any obligation or covenant in any written agreement between Borrower and Lender; (2) Borrower makes any false statement or representation in this agreement; (3) a receiver is appointed for Borrower; (4) bankruptcy or insolvency proceedings are commenced against or by any of the following parties: Borrower; any partnership of which Borrower is a general partner; or any maker, drawer, acceptor, endorser, guarantor, surety, accommodation party, or other person liable on or for any part of the note; and (5) any of the following parties are dissolved: Borrower; any partnership of which Borrower is a general partner; or any maker, drawer, acceptor, endorser, guarantor, surety, accommodation party, or other person liable on or for any part of the note.

Each Borrower is responsible for all obligations represented by this note.

When the context requires, singular nouns and pronouns include the plural.

____________________________________ ____________________________________

Social Security #: __________________ Social Security #: __________________

Related posts:

- Forfeiture of Improvements

- Assignment of Mortgage

- Bill of Sale- Assorted Legal Forms

- BUYING – Monster Purchase and Sale Agreement

- Deed Modification Agreement-Assorted Legal Forms

- GENERAL WARRANTY DEED – Deed Subject To

- Preliminary Credit Application-Assorted Legal Forms

- PROPERTY FACT SHEET – Assorted Legal Forms

- TESTIMONIAL LETTER

- Title Search