Search Bar

PROPERTY LOAN INFO VERIFICATION SHEET-Assorted Legal Forms

Property loan info verification sheet

Financial emergencies are very common nowadays. Our business minded world does not allow us to patch up financial emergencies so easily. Sometimes unavoidable financial emergencies may occur in a family. You will have to seek fiscal aid from available resources. Getting a loan is one of the best ways to tackle such emergencies. There are many banks in the world today. No matter where in the world you are, your locality will have the branches of at least 5 banks. You need to have a bank account to take a loan. Sometimes ordinary loan schemes wont cover your requirement. In such cases, you can fill up a property loan info verification sheet and apply for a property loan. This way, you are giving the bank an assurance.

There are some standard procedures before granting property loans. Bank authorities will inspect the property and make an assessment. You cannot ask for one million dollars for a small farm house. The authorities will analyze the market value of your property and compare it with your claim. Verification of documents is also an intricate process of property loan. Usually you will be able to receive money within a week after verification process.

If you want to make maximum benefit out of your property, you should compare the schemes of different banks. If you can find a bank that will provide high loan amount, low interest rate, and long tenure, you can apply there. It will be better to seek legal assistance, if you are not familiar with all these financial processes.

Where to download PROPERTY LOAN INFO VERIFICATION SHEET-Assorted Legal Forms Template?

(No Ratings Yet)

(No Ratings Yet)Sample Template Preview

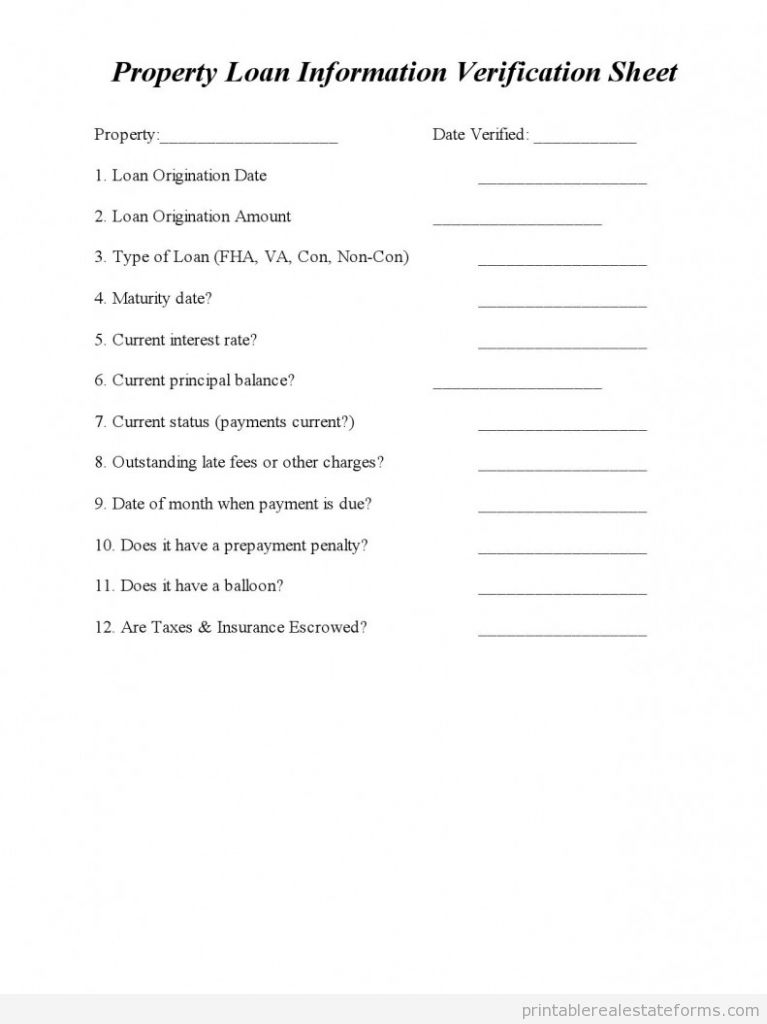

Property Loan Information Verification Sheet

Property:___________________ Date Verified: ___________

1. Loan Origination Date __________________

2. Loan Origination Amount __________________

3. Type of Loan (FHA, VA, Con, Non-Con) __________________

4. Maturity date? __________________

5. Current interest rate? __________________

6. Current principal balance? __________________

7. Current status (payments current?) __________________

8. Outstanding late fees or other charges? __________________

9. Date of month when payment is due? __________________

10. Does it have a prepayment penalty? __________________

11. Does it have a balloon? __________________

12. Are Taxes & Insurance Escrowed? __________________

Related posts:

- Forfeiture of Improvements

- Assignment of Escrow Funds and Insurance

- Assignment of Mortgage

- CYA- Due On Sale

- Deed Modification Agreement-Assorted Legal Forms

- Power of Attorney 2 -Appointment of Property Manager with LP

- Power of Attorney – Assorted

- Preliminary Credit Application-Assorted Legal Forms

- TERMINATION OF SALE MUTUAL RELEASES – Assorted Legal Forms

- TESTIMONIAL LETTER