Search Bar

CYA- Due On Sale

Some important terms of a loan agreement

A few years ago, only the richest people used to invest in real estate. Now however most of the middle class people are stepping into this market. They do not need to invest all the money right away. All they need is a small part of the total value in form of the down payment and the rest they can get through a loan. And they best part is that the property they are about to buy can act as a security. So, they need exactly nothing extra. Many of the people even rent out the property and then use this money to pay the installments. It thus is a really nice plan for those who want to create a big estate from their regular job.

If you too want to do the same, you should know about some of the terms of this type of loan. The most important one is the due on sale clause. According to this, all the due will be considered paid in full if or when the property is sold. This means that is the borrower wants to sell the property while the loan still stands, he should either pay the amount if full from the money he gets from the deal or transfer the loan to the new buyer. In any case the actual buyer who took loan will be free from it. This clause is added to every loan agreement these days. It is beneficial for both the lender and the borrower.

Where to download CYA- Due On Sale Template?

(No Ratings Yet)

(No Ratings Yet)Sample Template Preview

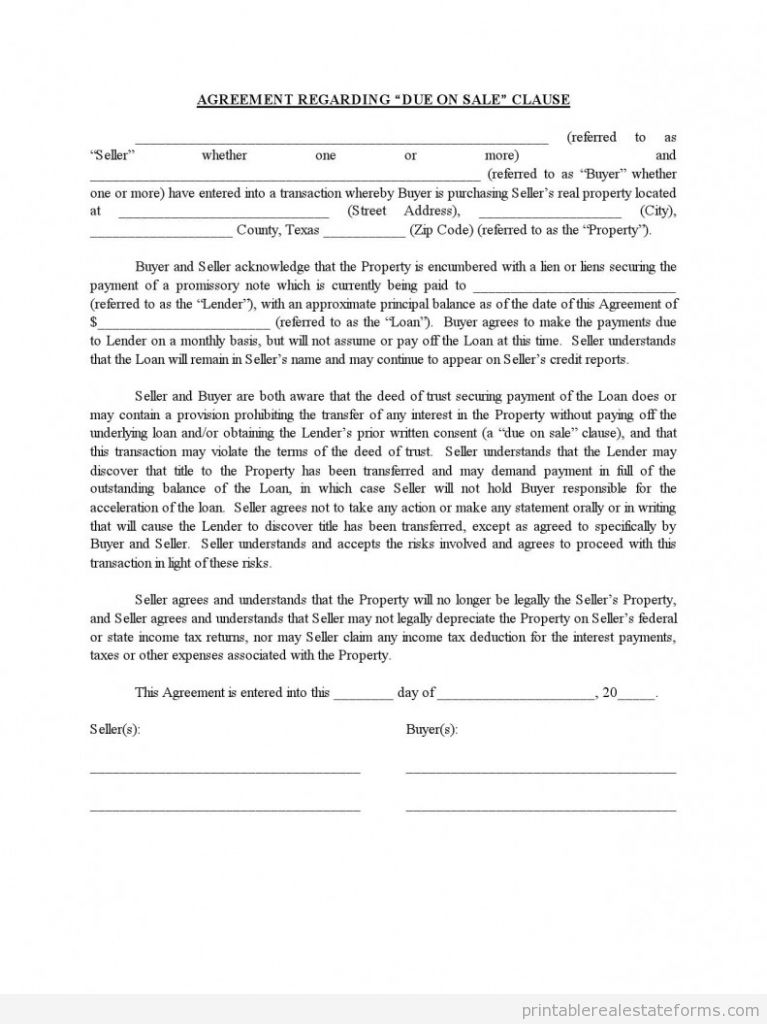

AGREEMENT REGARDING “DUE ON SALE” CLAUSE

_______________________________________________________ (referred to as “Seller” whether one or more) and ____________________________________________________ (referred to as “Buyer” whether one or more) have entered into a transaction whereby Buyer is purchasing Seller’s real property located at ____________________________ (Street Address), ___________________ (City), ___________________ County, Texas ___________ (Zip Code) (referred to as the “Property”).

Buyer and Seller acknowledge that the Property is encumbered with a lien or liens securing the payment of a promissory note which is currently being paid to ___________________________ (referred to as the “Lender”), with an approximate principal balance as of the date of this Agreement of $_______________________ (referred to as the “Loan”). Buyer agrees to make the payments due to Lender on a monthly basis, but will not assume or pay off the Loan at this time. Seller understands that the Loan will remain in Seller’s name and may continue to appear on Seller’s credit reports.

Seller and Buyer are both aware that the deed of trust securing payment of the Loan does or may contain a provision prohibiting the transfer of any interest in the Property without paying off the underlying loan and/or obtaining the Lender’s prior written consent (a “due on sale” clause), and that this transaction may violate the terms of the deed of trust. Seller understands that the Lender may discover that title to the Property has been transferred and may demand payment in full of the outstanding balance of the Loan, in which case Seller will not hold Buyer responsible for the acceleration of the loan. Seller agrees not to take any action or make any statement orally or in writing that will cause the Lender to discover title has been transferred, except as agreed to specifically by Buyer and Seller. Seller understands and accepts the risks involved and agrees to proceed with this transaction in light of these risks.

Seller agrees and understands that the Property will no longer be legally the Seller’s Property, and Seller agrees and understands that Seller may not legally depreciate the Property on Seller’s federal or state income tax returns, nor may Seller claim any income tax deduction for the interest payments, taxes or other expenses associated with the Property.

This Agreement is entered into this ________ day of _____________________, 20_____.

Seller(s): Buyer(s):

____________________________________ ____________________________________

____________________________________ ____________________________________

Related posts:

- Acquisition management letter

- Checklist for Acquisitions

- Checklist for Sales with New Loans Assorted Legal Forms

- CLOSING – DISCLOSURE – CONDITIONAL RELEASE

- Financial Statement-Assorted Legal Forms

- HUD 1 Settlement Statement-Assorted Legal Forms

- Mortgage Broker Submission- Assorted Legal Forms

- SALES CONTRACT FOR BUYING SUBJECT- Assorted Legal Forms

- Shortsale checklist given to sellers

- ULTIMATE DISCLOSURE